The blockchain landscape is entering a new phase in 2025—maturing beyond hype cycles and speculative assets into a foundational layer for real-world applications. As institutional players join forces with decentralized communities, new priorities are emerging around usability, scalability, and responsible innovation. No longer defined solely by cryptocurrency volatility, blockchain technology is evolving into a serious platform for finance, sustainability, governance, and enterprise systems.

Among the most influential blockchain trends shaping 2025 are the continued evolution of decentralized finance (DeFi), the urgent focus on environmental sustainability, and the long-anticipated realization of cross-chain interoperability. These aren’t isolated trends—they are interconnected pillars of a more secure, efficient, and inclusive digital economy.

Here’s a closer look at the top blockchain trends of 2025 and why they matter.

DeFi 2.0: Maturity, Modularity, and Risk Reduction

Decentralized finance (DeFi) shook the foundations of traditional banking in its first iteration—offering yield farming, decentralized exchanges (DEXs), and lending protocols without intermediaries. However, DeFi 1.0 faced major challenges: high volatility, unsustainable tokenomics, smart contract exploits, and a lack of real-world utility.

In 2025, DeFi 2.0 is focused on maturity and modularity. Protocols are becoming more composable, enabling developers to build sophisticated financial instruments by stacking secure and audited components. Capital efficiency is now prioritized over yield-maximizing schemes. Features like real-world asset tokenization, interest rate swaps, on-chain credit scoring, and undercollateralized lending are gaining traction.

DeFi’s integration with regulatory frameworks is also advancing. Several projects are working under regulated environments or sandbox licenses, giving rise to hybrid models that combine KYC-compliant user layers with decentralized settlement engines. Institutional capital is entering the space more cautiously, supported by improved audit tools, AI-based risk monitoring, and insurance primitives.

By the end of 2025, DeFi will look more like a decentralized Wall Street—open, transparent, but far more resilient and structured than in its experimental phase.

Green Blockchain: Sustainability Moves to the Forefront

Environmental concerns around blockchain—especially the energy-intensive proof-of-work (PoW) consensus—have drawn criticism from policymakers and climate activists for years. But in 2025, the narrative is shifting from damage control to innovation-driven sustainability leadership.

Ethereum’s transition to proof-of-stake (PoS) in 2022 laid the groundwork. Now, nearly every major blockchain has either moved to PoS or adopted hybrid models. Networks like Solana, Avalanche, and Cardano are now pushing energy usage per transaction below that of traditional Visa networks.

Moreover, blockchain is increasingly being used to support sustainability efforts. Projects are launching carbon offset marketplaces, enabling tokenized carbon credits to be transparently verified and traded. Smart contracts automate emissions reporting for corporations, while supply chain blockchains track eco-friendly sourcing of raw materials.

Blockchain’s immutability is becoming an asset for ESG compliance and green finance, ensuring that sustainability claims are not just marketing—but verifiable commitments. The rise of regenerative finance (ReFi), a movement combining crypto tools with environmental goals, is gaining serious attention from impact investors, NGOs, and startups.

The focus has moved from asking “is blockchain sustainable?” to asking “how can blockchain drive sustainability at scale?”

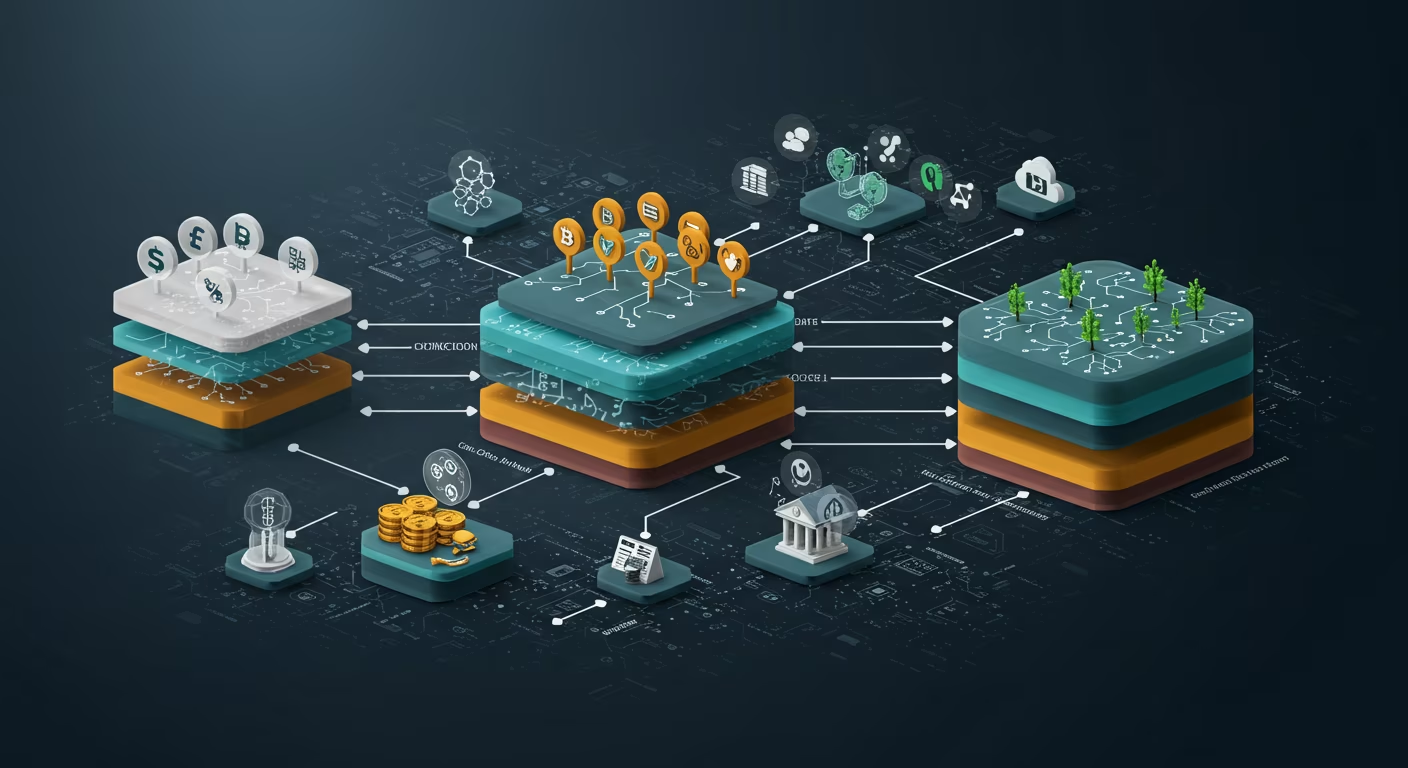

Cross-Chain Interoperability: The Multi-Chain Future Arrives

One of the most anticipated promises of blockchain has always been interoperability—the ability for different blockchains to communicate, share data, and transfer value seamlessly. In 2025, this vision is finally becoming reality, addressing long-standing fragmentation in the ecosystem.

Early bridges and wrapped assets were clunky, slow, and vulnerable to hacks. But the emergence of next-gen interoperability protocols like Cosmos IBC, Polkadot parachains, LayerZero, and Chainlink’s CCIP are enabling secure, programmable cross-chain messaging. These innovations allow developers to build apps that span multiple chains natively.

For users, this means no more worrying about which blockchain their tokens are on. Wallets and protocols now support aggregated liquidity across chains, auto-routing transactions to the most efficient networks.

Interoperability also unlocks new use cases—such as cross-chain lending, multi-chain DAOs, and omnichain NFTs that evolve across ecosystems. Enterprise blockchains, often siloed in private ledgers, are integrating with public chains to share data securely and tap into global liquidity.

The multi-chain world is no longer a dream—it’s a functional, composable reality. Interoperability is the new scalability.

Blockchain and AI Convergence

Artificial intelligence (AI) and blockchain are two of the most transformative technologies of our time. In 2025, they are increasingly converging—not in competition, but in collaboration.

AI needs trustworthy data sources and audit trails. Blockchain provides tamper-proof records and decentralized identity layers that enable secure data provenance, a critical requirement for responsible AI training. Projects are using blockchain to track AI model development, govern decentralized AI marketplaces, and distribute data usage royalties through smart contracts.

Meanwhile, AI is powering on-chain intelligence. From fraud detection in DeFi protocols to optimizing DAO governance, AI is being deployed to make decentralized systems smarter, more adaptive, and more user-friendly.

One standout trend is blockchain-powered AI data commons—where data contributors are rewarded in tokens and AI models are trained collaboratively and transparently. The result is a democratized AI ecosystem that prioritizes ethics, equity, and innovation.

Enterprise Adoption Grows Cautiously, But Steadily

Big corporations are no longer ignoring blockchain—they’re integrating it. From IBM and Microsoft to Goldman Sachs and Nike, enterprises are deploying blockchain in supply chains, finance, loyalty programs, digital identity, and asset tokenization.

In 2025, enterprise blockchain adoption is being driven by practical benefits: auditability, compliance, efficiency, and transparency. Tokenization of real-world assets—ranging from real estate to private equity—is streamlining ownership structures and expanding access to previously illiquid markets.

What’s different now is that corporates are building on modular, interoperable blockchain layers, often in collaboration with public protocols. Permissioned systems are connecting with permissionless networks through controlled gateways. Compliance-focused solutions are integrating zero-knowledge proofs to meet privacy needs without sacrificing transparency.

Enterprise adoption is no longer just about experimentation—it’s about long-term value and strategic integration.

The Rise of Chain Abstraction and UX Innovation

For blockchain to reach mainstream adoption, it must become invisible. In 2025, “chain abstraction” is taking center stage—making the user experience so intuitive that users no longer need to understand what chain they’re on or how wallets work.

Smart wallets with account abstraction allow users to recover access with email, social login, or biometrics. Gasless transactions and one-click swaps are eliminating friction. Interfaces now aggregate assets across chains, allowing users to interact with dApps without switching networks.

This trend is critical to onboarding the next billion users—especially in regions where traditional banking infrastructure is limited. As blockchain applications become more mobile-friendly and use-case-driven (gaming, social media, remittances), the technology disappears into the background.

UX is no longer an afterthought—it’s a core driver of blockchain’s global adoption curve.

Blockchain in 2025 Is About Impact, Not Hype

The blockchain trends of 2025 reveal a technology maturing into its full potential. With DeFi evolving into robust financial infrastructure, sustainability becoming a priority, and interoperability enabling a seamless multi-chain future, blockchain is no longer a siloed innovation—it’s becoming part of the global digital fabric.

The convergence of blockchain with AI, the rise of user-centric design, and responsible enterprise adoption show that this is not just a developer playground anymore—it’s a platform for transformative real-world solutions.

Blockchain in 2025 isn’t about coins or speculation. It’s about coordination, transparency, and trust—woven into the infrastructure of business, society, and the internet itself.