Despite a slight cooling in home prices and rising buyer interest, new listings of U.S. homes have dropped to their lowest point in nearly two years, according to recent data from Redfin and Realtor.com. The supply crunch is creating significant challenges for homebuyers and contributing to continued market imbalance even as mortgage rates hover near multi-decade highs.

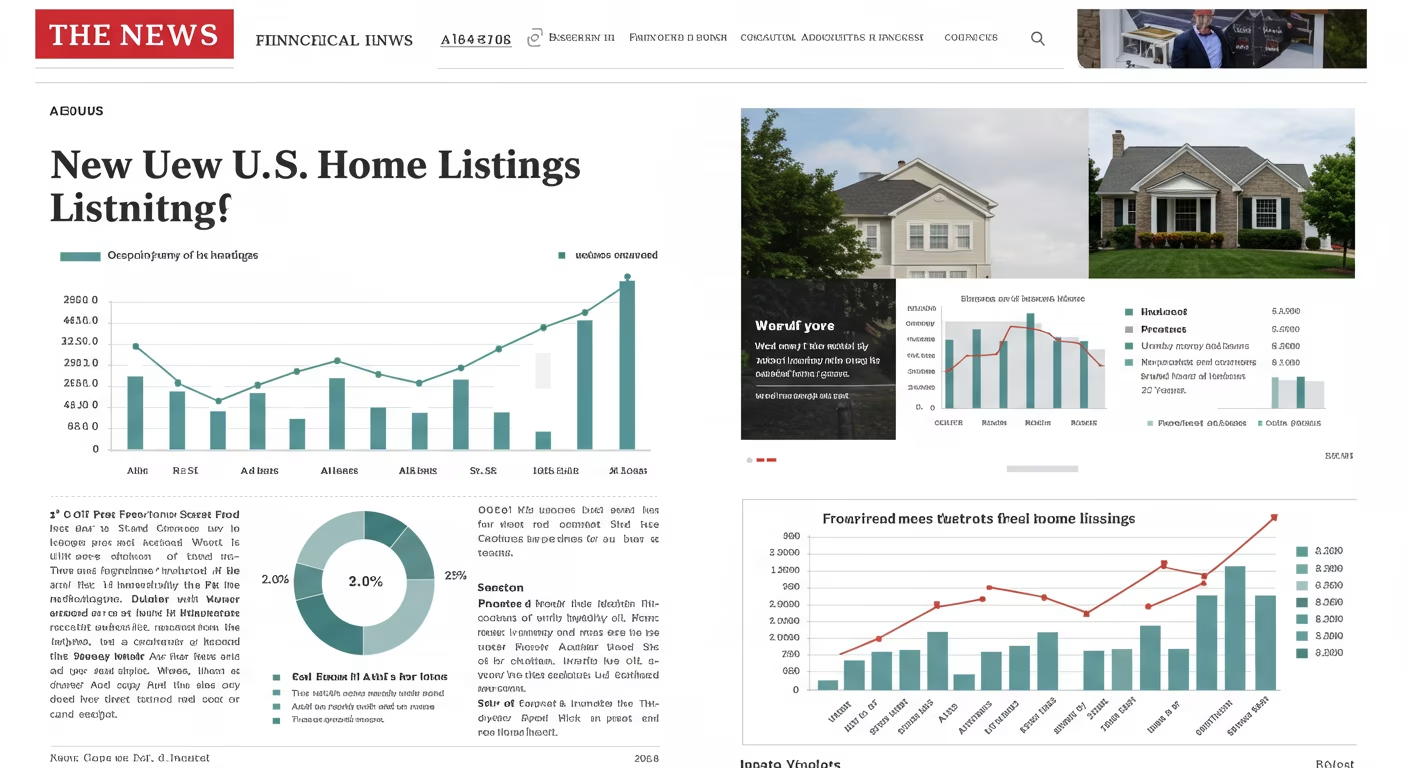

In June 2024, the number of newly listed homes fell by more than 25% year-over-year, marking the lowest level of fresh inventory since late 2022. While existing inventory has slowly increased due to homes lingering longer on the market, the flow of new properties hitting the market has slowed to a trickle.

This trend is frustrating for buyers hoping that higher mortgage rates and slower price appreciation would bring more opportunity. Instead, they’re facing a market where choices are limited, competition remains strong in many areas, and affordability is still a serious barrier.

So why are homeowners sitting on the sidelines, and what does this historic shortage of new listings mean for the housing market in the months ahead?

What the Numbers Show

Redfin reports that new home listings in June fell to their lowest seasonal level since July 2022, despite early summer usually being the most active time of year for real estate. Compared to June 2023:

- New listings were down 25.3% nationwide.

- The number of total active listings was down 15.6%, due to homes not turning over.

- In some major markets like Los Angeles, Boston, and Seattle, new listings fell more than 30% year-over-year.

This sharp drop is adding pressure to a housing market already starved for inventory, with buyers having to choose from an increasingly narrow selection of available homes—many of which are overpriced, outdated, or already under contract.

The Mortgage Rate Lock-In Effect

The primary reason for the decline in new listings is what economists call the “lock-in effect.” Homeowners who purchased or refinanced during the pandemic are sitting on ultra-low mortgage rates, often below 3%. With today’s average 30-year fixed mortgage rate hovering near 6.9%, selling a home and buying another means trading a cheap monthly payment for a far more expensive one.

This financial trade-off is keeping a huge share of homeowners in place, even if they’ve outgrown their homes or want to relocate. According to Zillow, over 80% of U.S. homeowners currently have a mortgage rate under 5%, making the idea of moving—unless absolutely necessary—a tough sell.

As a result, only a small fraction of listings are coming from discretionary sellers. Most new inventory comes from:

- Estate sales or inheritance

- Relocations for job or family

- Distressed or investor-owned properties

In essence, people aren’t selling unless they have no other option.

Low Listings Mean Prices Stay Sticky

In a typical market, falling buyer demand would lead to falling prices. But this isn’t a typical market. Because so few homes are coming up for sale, prices are staying high—even as sales volume slows.

National median home prices in June were up 2.1% year-over-year, despite mortgage rates rising and affordability hitting a 30-year low. The simple reason is that demand, although reduced, still exceeds the available supply in most regions.

Some metro areas that have seen the most dramatic listing shortages—and price resilience—include:

- Charlotte, NC

- Indianapolis, IN

- Tampa, FL

- San Diego, CA

In these markets, well-maintained homes in desirable neighborhoods are still receiving multiple offers, even if they’re taking slightly longer to sell.

Homebuilders Trying to Fill the Gap

With resale inventory suppressed, homebuilders are stepping in to meet demand, especially in Sun Belt markets like Texas, Florida, and Arizona. New construction now makes up a larger share of total home sales than at any time since the early 2000s.

Builders are also offering incentives such as:

- Interest rate buydowns

- Closing cost credits

- Free upgrades or design packages

However, newly built homes often come at a premium and are typically located in suburban or exurban areas—limiting their appeal for urban buyers or those on tight budgets.

Regional Trends in Listings Shortage

While the national trend shows a decline in new listings, the impact varies by region. Here’s a breakdown of where listings have dried up the most:

- West Coast: San Francisco, San Diego, and Portland are seeing listing declines of over 30%, driven by high prices and tax burdens.

- Northeast: Boston, New York City suburbs, and Philadelphia are tight due to older homeowners staying put and limited new construction.

- Midwest: Markets like Minneapolis and Cleveland have more balanced inventory but still fewer listings than historical norms.

- South: Some areas like Raleigh and Nashville are seeing a relative pickup in new listings—mostly due to strong job growth and inbound migration.

How Buyers Can Navigate This Market

For homebuyers still determined to purchase in 2024, this environment requires patience and strategy:

- Expand your search radius: Consider nearby towns or neighborhoods that may be overlooked.

- Get pre-approved and act quickly: Homes that are priced right and move-in ready still go fast.

- Be open to homes needing light updates: You may find value in properties others skip.

- Work with an experienced local agent: Someone who knows how to identify off-market deals or upcoming listings can give you an edge.

- Consider new construction: Builders may offer more flexibility than private sellers.

What Sellers Should Know

While inventory is low and prices are holding steady, today’s market is not the frenzy of 2021. Sellers still need to:

- Price appropriately—overpricing will lead to stagnation.

- Stage and market well—online presentation is key.

- Be flexible on contingencies or closing terms—buyers are more cautious.

- Work with professionals to evaluate appraisal risks and buyer financing reliability.

Will Listings Rebound Anytime Soon?

Analysts say that new listings are unlikely to rise significantly until mortgage rates fall meaningfully below 6%. A broader economic shift, such as a Fed rate cut or improvements in wage growth, could also help loosen the logjam.

But unless something forces homeowners to sell en masse—such as job loss, policy change, or another black swan event—low listing volumes may be the norm for the foreseeable future.

A Market Starved for Fresh Supply

The dramatic drop in new home listings is reshaping the housing market in 2024. Despite rising rates and stretched affordability, a lack of fresh inventory is keeping prices elevated and competition steady, frustrating both buyers and sellers.

Unless borrowing costs drop or life circumstances push more owners to sell, the U.S. real estate market will remain supply-starved and structurally imbalanced. For now, buyers must be strategic, and sellers must be realistic—because inventory, more than ever, is driving the market.