In a global economy defined by volatility, foreign exchange and gold reserves serve as the financial safety net for sovereign nations. These reserves provide countries with the ability to stabilize their currencies, pay for imports, service foreign debt, and build investor confidence. For many African economies, however, maintaining sufficient reserves remains a persistent challenge. Factors such as low export revenues, high debt burdens, political instability, and currency depreciation have left several nations exposed to external shocks.

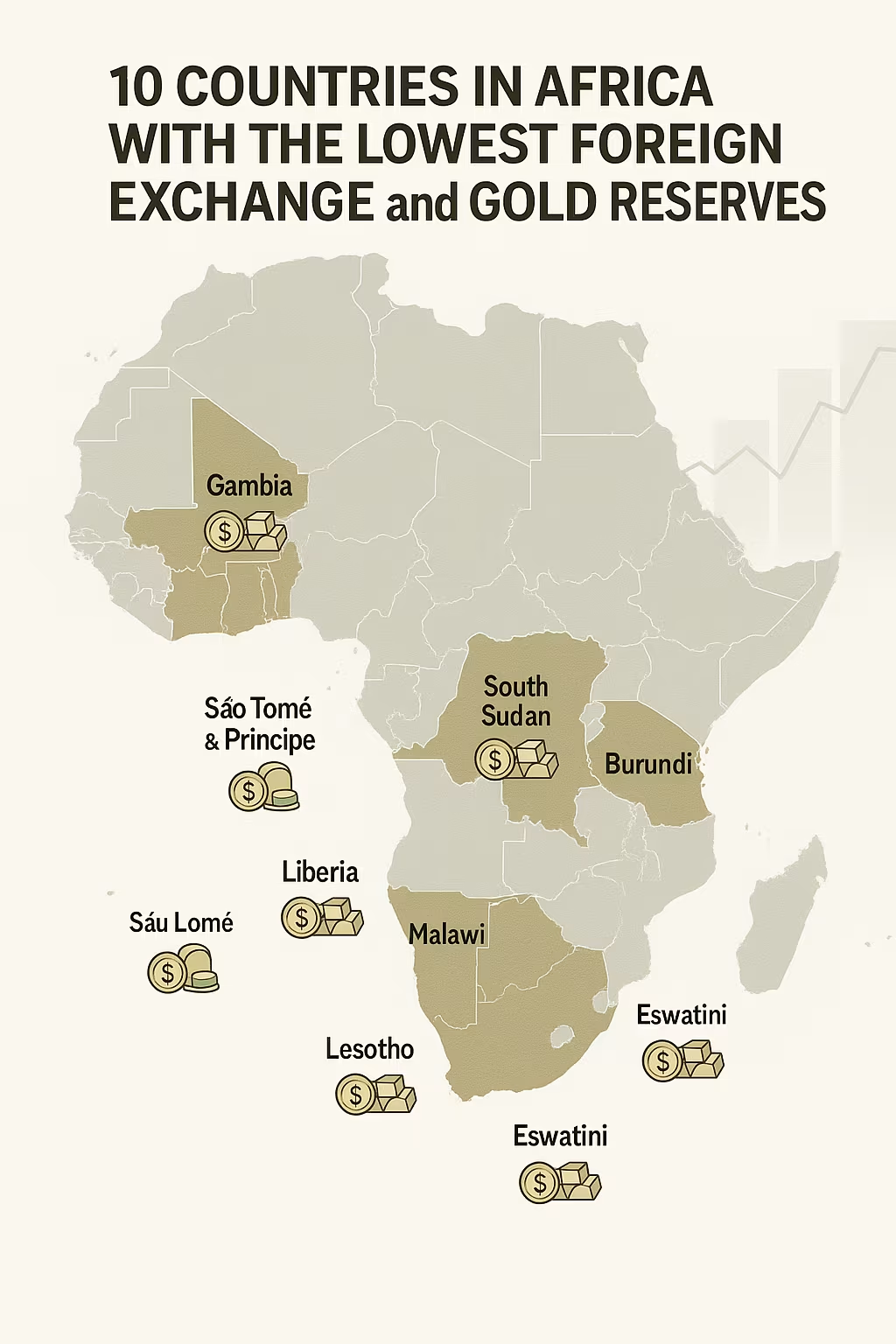

This article explores the top 10 African countries with the lowest combined foreign exchange and gold reserves in 2025, and examines the implications of their limited financial buffers on economic stability, development, and crisis response.

1. Sierra Leone

Estimated Reserves: Under $600 million

Sierra Leone’s small economy, which relies heavily on mineral exports like diamonds and iron ore, is vulnerable to price volatility and external debt pressures. The country’s reserves are insufficient to provide long-term currency support or withstand major global shocks. Low reserve levels also limit its capacity to import essential goods during crises.

2. The Gambia

Estimated Reserves: Under $500 million

The Gambia has one of the smallest economies in Africa and depends largely on agriculture, tourism, and remittances. Its limited exports and narrow tax base constrain foreign currency inflows. The central bank’s reserves are barely enough to cover a few months of imports, leaving the country exposed to balance-of-payment risks.

3. Guinea-Bissau

Estimated Reserves: Under $500 million

Guinea-Bissau, often ranked among the world’s poorest nations, has struggled with chronic political instability, limited industrial output, and high external aid dependency. Its foreign reserves remain critically low, with virtually no significant gold holdings. This makes the economy highly vulnerable to external funding disruptions and commodity price shocks.

4. Burundi

Estimated Reserves: Around $600 million

Burundi’s reserve position remains weak due to ongoing political tensions, trade imbalances, and overreliance on agricultural exports like coffee and tea. High inflation and currency depreciation have further eroded reserve adequacy. The country’s limited foreign assets restrict its ability to stabilize the Burundian franc or attract investor confidence.

5. Liberia

Estimated Reserves: Under $700 million

Liberia has made strides in post-conflict reconstruction, but it still faces major economic hurdles. Exports are dominated by raw commodities like rubber and iron ore, with little diversification. Foreign reserves are minimal, and gold holdings are negligible. This leaves the country dependent on international aid and vulnerable to external market fluctuations.

6. Comoros

Estimated Reserves: Under $650 million

As a small island nation with limited economic activity, Comoros struggles with trade deficits, weak industrial output, and a heavy dependence on remittances. Its foreign exchange reserves remain low and fluctuate based on donor support. Limited gold reserves further highlight its fragile economic safety net.

7. Central African Republic (CAR)

Estimated Reserves: Around $700 million

Despite its resource-rich potential, the Central African Republic remains economically marginalized due to armed conflict and weak infrastructure. The country’s foreign reserves are thin, making it ill-equipped to manage currency volatility or external payment pressures. Persistent insecurity also discourages foreign investment and reserve buildup.

8. Togo

Estimated Reserves: Slightly above $700 million

Togo’s economy has shown some growth in infrastructure and logistics, but its reserve accumulation remains limited. The country imports more than it exports, resulting in ongoing current account deficits. Foreign reserves are not enough to absorb external shocks or long-term currency fluctuations.

9. Lesotho

Estimated Reserves: Below $800 million

Lesotho, a landlocked country with economic dependence on South Africa, struggles with low reserves despite a fixed exchange rate policy. Its economy is reliant on remittances and textile exports, both of which are sensitive to external conditions. The lack of gold reserves adds to its monetary inflexibility.

10. São Tomé and Príncipe

Estimated Reserves: Below $400 million

This island nation has one of the smallest economies in Africa and is heavily dependent on foreign aid and limited tourism. Its foreign reserves are extremely low, barely covering basic import needs. With almost no gold reserves, São Tomé and Príncipe remains highly exposed to global price shocks and aid volatility.

Why Low Reserves Matter

When a country has inadequate foreign exchange and gold reserves, the economic consequences can be severe. These include:

- Currency Instability: A lack of reserves makes it difficult for central banks to defend the national currency against depreciation, fueling inflation.

- Debt Vulnerability: Countries with low reserves struggle to repay foreign debt, risking defaults or downgrades by credit agencies.

- Import Shortages: Insufficient reserves mean that essential imports—like food, fuel, and medicine—become unaffordable during external shocks.

- Investor Flight: Low reserves erode investor confidence and deter capital inflows, further exacerbating economic fragility.

- Dependence on Aid: These nations often rely heavily on IMF loans, donor funds, or bilateral assistance to survive economic downturns.

Root Causes of Low Reserves in Africa

Several structural challenges contribute to low reserve levels across these countries:

- Commodity Dependence: Most rely on a narrow range of exports, such as oil, minerals, or cash crops, which are vulnerable to price swings.

- Limited Industrialization: The lack of value-added production means fewer foreign earnings from goods and services.

- Political Instability: Insecurity and governance issues hinder economic planning, investment, and sustained growth.

- Debt Servicing: Rising external debt levels consume a large portion of forex earnings, leaving little room for reserve accumulation.

- Poor Fiscal Management: Budget deficits and weak public institutions prevent strategic financial planning and savings.

The Road Ahead: Building Financial Resilience

To strengthen their financial position, African nations with low reserves must focus on:

- Diversifying exports to reduce dependence on volatile commodities

- Strengthening fiscal policy and reducing debt overhangs

- Improving political stability and rule of law to attract investment

- Investing in domestic industries to create foreign exchange-generating sectors

- Boosting remittances and tourism as alternative income sources

While donor aid and international lending will continue to play a role, true economic security lies in building internal resilience and reserve adequacy over time.

In a world shaped by rising interest rates, geopolitical shocks, and shifting trade patterns, the ability of a country to weather financial turbulence depends significantly on its foreign exchange and gold reserves. The African countries listed here face a heightened risk of economic instability due to their limited reserve holdings. Without meaningful structural reforms, these nations remain exposed to currency crises, inflationary shocks, and prolonged dependency on external aid. Strengthening reserves is not just about numbers—it’s about building a foundation for financial sovereignty, economic stability, and sustainable growth.