In just over a decade, Bitcoin has evolved from a mysterious digital experiment into a global financial phenomenon. Launched in 2009 by the pseudonymous developer Satoshi Nakamoto, Bitcoin introduced the world to the concept of decentralized digital currency. Today, it is not just a speculative asset—it is a disruptive force challenging traditional economic models, banking systems, and even national currencies.

As inflation, political instability, and distrust in central banks rise, Bitcoin is increasingly seen as a store of value, often referred to as “digital gold.” But what drives its value? How is it impacting the global economy? And where is it heading next? Let’s dive into the economics behind Bitcoin.

The Economics of Scarcity

Bitcoin’s value proposition begins with its limited supply. Only 21 million bitcoins will ever exist, a cap hard-coded into its protocol. This creates artificial scarcity, mimicking the characteristics of precious metals like gold. As demand increases while supply remains fixed, basic economic theory predicts a rise in price—a pattern that Bitcoin has largely followed.

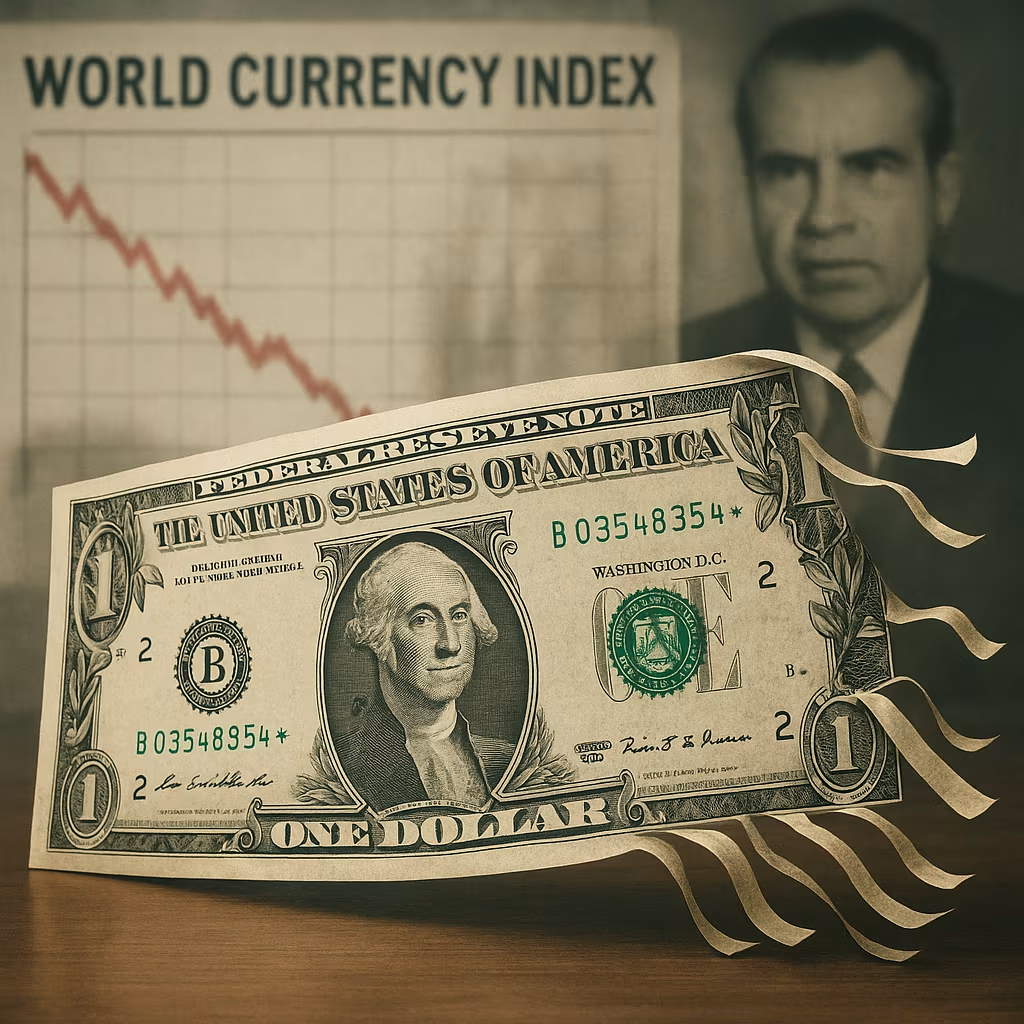

Unlike fiat currencies, which central banks can print endlessly, Bitcoin’s issuance is controlled through a process called mining, where powerful computers solve complex mathematical problems. Every four years, the reward for mining is halved—a built-in mechanism known as the halving cycle—which historically has triggered price rallies due to reduced supply flow.

Bitcoin as a Hedge Against Inflation

With traditional currencies losing purchasing power amid rising inflation, Bitcoin has emerged as a popular hedge. Investors, especially millennials and institutional players, are turning to Bitcoin to preserve wealth. Unlike traditional hedging assets like bonds or gold, Bitcoin offers:

- Portability

- Divisibility

- Instant transferability across borders

- Transparent, algorithmic supply management

During times of economic uncertainty, especially post-pandemic and amid global geopolitical tensions, Bitcoin has shown resilience and growth, outperforming many traditional assets.

Impact on Global Finance

Bitcoin’s rise is challenging the foundations of traditional finance:

- Decentralization: Bitcoin eliminates the need for intermediaries like banks. This is revolutionary for the unbanked populations in developing countries who can now access financial systems with just a smartphone.

- Cross-border payments: Traditional remittances are costly and slow. Bitcoin allows instant, low-fee international transfers, disrupting services like Western Union or SWIFT.

- Financial sovereignty: In countries with unstable currencies like Venezuela or Argentina, citizens are turning to Bitcoin to escape hyperinflation and capital controls.

Bitcoin is empowering individuals globally to take control of their financial futures—without reliance on governments or institutions.

The Regulatory Tightrope

Despite its benefits, Bitcoin is not without controversy. Governments and central banks fear loss of control over monetary policy, financial surveillance, and tax systems. Regulatory responses vary widely:

- El Salvador adopted Bitcoin as legal tender.

- The U.S. and EU are developing regulatory frameworks.

- China has banned all crypto-related activities.

Regulation can influence Bitcoin’s adoption and market volatility. Clear and favorable regulations could accelerate integration into the mainstream financial system.

Challenges and Criticisms

Bitcoin is far from perfect. Key criticisms include:

- Volatility: Bitcoin prices can swing dramatically, limiting its use as a stable currency.

- Energy consumption: Bitcoin mining consumes more electricity than some countries, raising environmental concerns.

- Scalability: The Bitcoin network processes far fewer transactions per second compared to Visa or Mastercard.

However, ongoing developments such as the Lightning Network and the rise of green mining are addressing these concerns.

The Future of Bitcoin

Bitcoin’s future remains uncertain but promising. Several trends point toward continued relevance:

- Increased institutional adoption (BlackRock, Fidelity)

- Integration into traditional payment systems (PayPal, Stripe)

- Potential for central banks to hold BTC as reserve assets

While risks remain, Bitcoin continues to gain trust, recognition, and utility. Whether as a speculative asset, a hedge against inflation, or a catalyst for financial inclusion, Bitcoin has undeniably secured its place in the modern economic narrative.

Bitcoin is more than just a digital currency—it is a new economic paradigm. With its fixed supply, decentralized nature, and global accessibility, Bitcoin is forcing economists, policymakers, and investors to rethink the future of money. As the world continues to digitize and decentralize, Bitcoin could very well become the foundation of a new, more inclusive global financial system.