In today’s financial markets, information is power. Traders, economists, and institutional investors rely heavily on government-released data such as GDP growth, inflation reports, and employment numbers to guide decisions worth billions. Yet, skepticism around the timeliness, accuracy, and even transparency of official statistics has been growing. Revisions to labor market figures, discrepancies in inflation reporting, and the political nature of economic announcements have left many macro investors searching for alternative ways to verify or challenge what government reports suggest.

The question isn’t whether official data matters—it does. Markets move instantly on every release. The deeper issue is whether investors can afford to depend solely on government numbers without cross-checking other sources. Many seasoned macro investors now complement official releases with independent datasets, private-sector surveys, and cutting-edge analytics. Here are seven alternative sources that institutional investors and hedge funds often turn to when government data raises doubts.

Private Payroll Processors and HR Platforms

Employment figures from government agencies are among the most closely watched indicators. However, they are also subject to substantial revisions that can alter market sentiment weeks later. To get a timelier snapshot of labor trends, many investors look to payroll processors and HR technology platforms. Companies such as ADP and UKG aggregate payroll and time-tracking data from millions of employees across industries. Their reports often capture hiring trends, wage growth, and absenteeism faster than official numbers. Because they draw directly from employer payroll systems, these datasets provide a “real economy” view without the lag. Macro traders use them to front-run labor market releases or to verify whether a sudden government employment shift looks plausible.

Freight and Logistics Data

Goods movement is one of the clearest windows into economic activity. Investors skeptical of GDP growth estimates often turn to shipping, freight, and logistics data. Metrics from companies like FreightWaves or Cass Information Systems track truckload volumes, rail shipments, and port traffic in near real-time. This data provides insights into supply chain bottlenecks, industrial production, and consumer demand. For example, a drop in trucking demand ahead of government retail sales reports can signal weaker consumption, while a surge in container imports may foreshadow rising manufacturing activity. Hedge funds often cross-reference freight volumes with official trade balances to determine whether government numbers are overstating or understating demand.

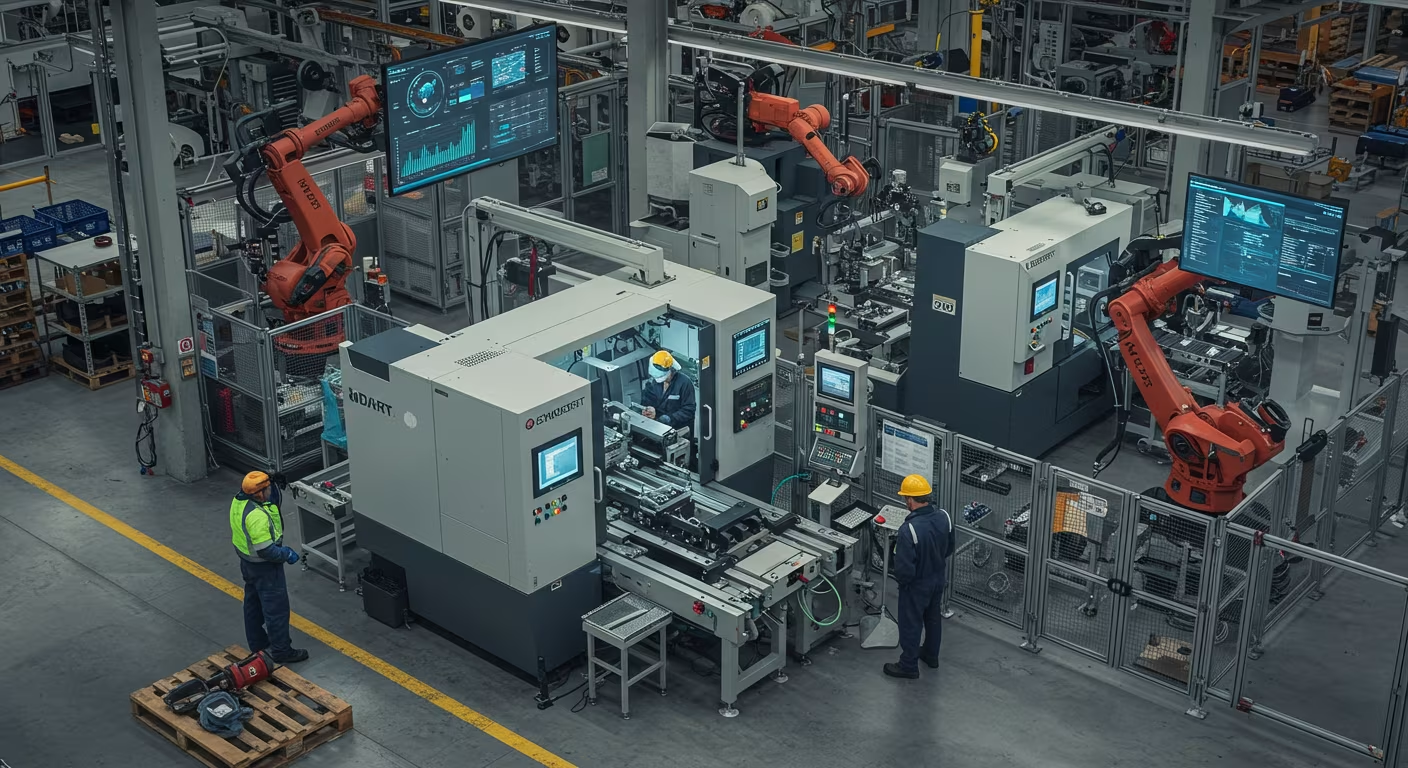

Satellite Imagery and Geospatial Intelligence

Perhaps one of the most innovative alternative data sources is satellite imagery. Firms specializing in geospatial intelligence can measure activity levels at factories, shipping yards, and even retail parking lots. By counting cars outside shopping centers or tracking oil tanker movements, investors gain early clues into consumer behavior and energy demand. For macro investors, satellite data is particularly valuable for global economies where government reporting is less transparent. Tracking oil field activity in the Middle East, crop yields in Brazil, or industrial pollution in China often provides a more reliable picture than official statistics. Increasingly, hedge funds are building sophisticated models that combine government data with satellite feeds to adjust investment theses in real time.

Energy and Commodity Market Reports

Energy consumption is a direct measure of industrial and household activity. While official energy statistics are widely used, macro investors frequently consult independent commodity and energy market reports to cross-check government claims. Weekly petroleum reports from private firms, pipeline flow data, and refinery utilization rates offer a clearer sense of supply and demand. Commodity traders also follow agriculture market reports from industry groups, grain shipping data, and private crop assessments. These sources help investors anticipate inflationary pressures, especially in food and energy categories that often diverge from official consumer price indexes.

Consumer Transaction and Credit Card Data

Retail sales are a critical driver of economic growth, but government data often lags behind reality. To get a faster and more granular picture, investors analyze credit card spending and digital transaction flows from companies like Mastercard, Visa, and fintech providers. These datasets reveal not only how much consumers are spending but also where and on what categories. If official reports claim strong retail sales but transaction data shows weakness in discretionary spending, investors may discount the government’s optimism. This alternative source became especially popular during the pandemic, when consumer behavior shifted rapidly and government data could not keep up.

Private-Sector Economic Surveys

Another layer of insight comes from independent surveys run by trade groups, consultancies, and business associations. Indicators like the Institute for Supply Management (ISM) surveys, Purchasing Managers’ Index (PMI), and regional manufacturing polls provide forward-looking sentiment directly from businesses. Unlike government data, which is retrospective and statistical, these surveys reflect real-time expectations and corporate confidence. For macro hedge funds, such information can serve as a leading indicator of turning points in the economy. If CEOs signal contraction while government reports paint stability, investors may bet on a downturn before official numbers confirm it.

Market-Based Signals

Finally, some of the most trusted alternative data doesn’t come from surveys or reports at all—it comes from the markets themselves. Bond yields, interest rate swaps, commodity futures, and currency movements often reveal investor expectations long before government data acknowledges changing conditions. A sudden steepening of the yield curve may suggest growth expectations even if GDP numbers appear flat. Similarly, commodity price spikes in oil, copper, or wheat often precede government inflation reports. Macro investors track these signals as a form of collective intelligence: the aggregated bets of thousands of market participants may be a more accurate barometer than official statistics.

Why Investors No Longer Rely on Government Data Alone

The reliance on alternative data sources reflects a broader truth: official statistics, while important, are increasingly seen as incomplete. Governments face constraints in how quickly they can collect and publish information, and political considerations can sometimes cloud presentation. In contrast, alternative datasets offer immediacy, transparency, and granularity. However, these sources are not without risks. Payroll processors may not capture the informal economy, freight data may be skewed by seasonal effects, and satellite imagery requires complex interpretation. That is why the most sophisticated investors blend government data with multiple independent datasets to triangulate reality.

Conclusion: A Multi-Source Approach Is the New Standard

Macro investing is as much about information as it is about capital. The investors who thrive are those who recognize that government data, while vital, is only part of the puzzle. By supplementing official releases with alternative data—ranging from satellite imagery to credit card transactions—investors create a fuller, more resilient picture of global economic conditions. In an era of market uncertainty and rapid change, this diversified approach to information is no longer optional. It has become the standard for professionals who cannot afford to trade blindly on government announcements. For individual traders and institutional giants alike, the lesson is clear: trust the numbers, but verify them with alternative sources.