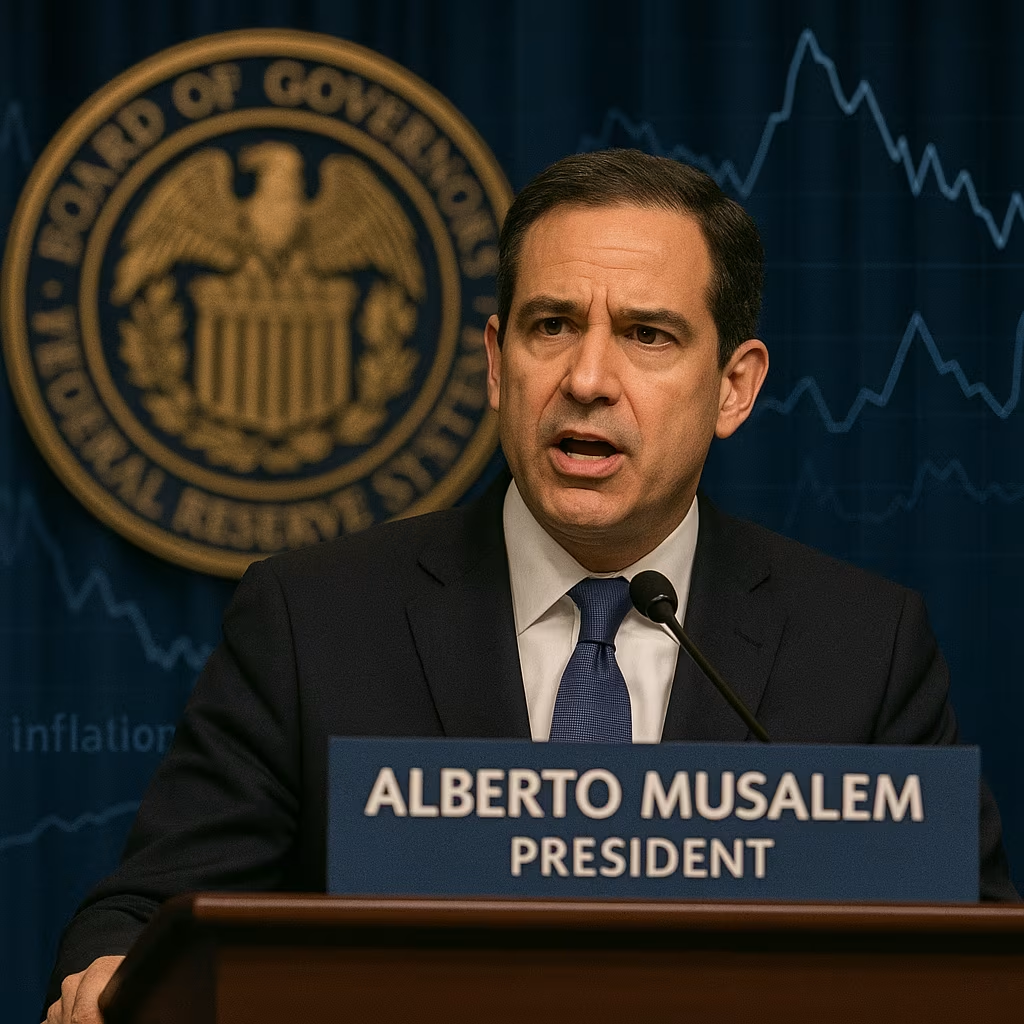

Federal Reserve Bank of St. Louis President Alberto Musalem has emphasized that inflation remains a more pressing concern than the labor market, signaling that the U.S. central bank will keep its focus firmly on restoring price stability before easing policy. His comments come as investors speculate about the timing of interest-rate cuts amid signs of a slowing economy and cooling inflation.

Inflation Still in the Spotlight

Speaking at a policy forum, Musalem made it clear that while the U.S. job market has softened slightly, inflation remains above the Federal Reserve’s 2% target and continues to pose risks to economic stability.

“The labor market is adjusting, but inflation is still elevated. Until we see more consistent evidence that price growth is returning to target, it would be premature to shift our focus away from inflation,” Musalem said.

His remarks echo the views of several other Federal Open Market Committee (FOMC) members who have stressed the importance of not declaring victory over inflation too soon.

The Current Economic Picture

The U.S. economy has been experiencing a gradual slowdown after the Fed’s aggressive tightening cycle, which raised interest rates to their highest levels in more than two decades. The latest economic data shows:

- Inflation – While headline inflation has eased from a peak of over 9% in 2022 to around 3%, it remains above the Fed’s target. Core inflation, which excludes food and energy, is proving more persistent.

- Labor Market – Job growth has moderated, unemployment has ticked up slightly, and job openings have declined, but the overall labor market remains historically tight.

- Consumer Spending – Higher borrowing costs have slowed household consumption, especially in interest-sensitive sectors like housing and durable goods.

- Business Investment – Firms are showing caution in expanding capacity as economic uncertainty and tighter credit conditions weigh on outlooks.

Why Inflation Is the Bigger Risk

Musalem argued that while some cooling in the labor market is natural and even desirable to help bring inflation down, allowing inflation to remain above target for too long could erode purchasing power, distort economic decision-making, and undermine the Fed’s credibility.

He warned that the risk of cutting rates too soon is greater than the risk of keeping them higher for a bit longer, noting that entrenched inflation expectations are harder to reverse once they take hold.

Balancing the Fed’s Dual Mandate

The Federal Reserve’s dual mandate requires it to promote both maximum employment and stable prices. At times, these goals can be in tension. In the current environment, Musalem believes that inflation control must take priority, even if it means tolerating a modest rise in unemployment.

This approach is consistent with the Fed’s broader strategy of ensuring that inflation expectations remain anchored, which in turn supports sustainable economic growth in the long run.

Market Implications

Musalem’s comments suggest that the Fed may not be in a hurry to cut rates, despite market bets on potential easing later this year. Treasury yields moved slightly higher following his remarks, while the U.S. dollar strengthened modestly against major currencies.

Equity markets were mixed, as investors weighed the prospect of prolonged high interest rates against the underlying strength of the U.S. economy.

Risks That Could Shift the Outlook

While Musalem’s baseline view is that inflation remains the greater risk, he acknowledged that unforeseen developments could alter the Fed’s policy path. Potential triggers for a faster pivot include:

- A sharp deterioration in the labor market with rapid job losses.

- A significant drop in consumer spending leading to a broader economic contraction.

- Global financial instability that disrupts credit markets or trade flows.

Even so, Musalem emphasized that any such shift would require clear and sustained evidence, not just one or two weaker data points.

The Road Ahead for Policy

Looking forward, Musalem expects the Fed to remain data-dependent, with each policy decision based on the latest readings for inflation, employment, and economic activity. He also highlighted the importance of patience, noting that the full effects of past rate hikes are still filtering through the economy.

This stance aligns with the Fed’s current preference for holding rates steady until there is more certainty that inflation is firmly on track to return to 2%.

Alberto Musalem’s message is clear: while the labor market is cooling, inflation remains the bigger challenge for the Federal Reserve. His comments reinforce the likelihood that the central bank will maintain a cautious stance on interest-rate cuts, prioritizing price stability over a rapid pivot to support jobs.

For businesses, investors, and households, this means preparing for an extended period of relatively high borrowing costs — at least until the Fed is convinced that inflation is fully under control.