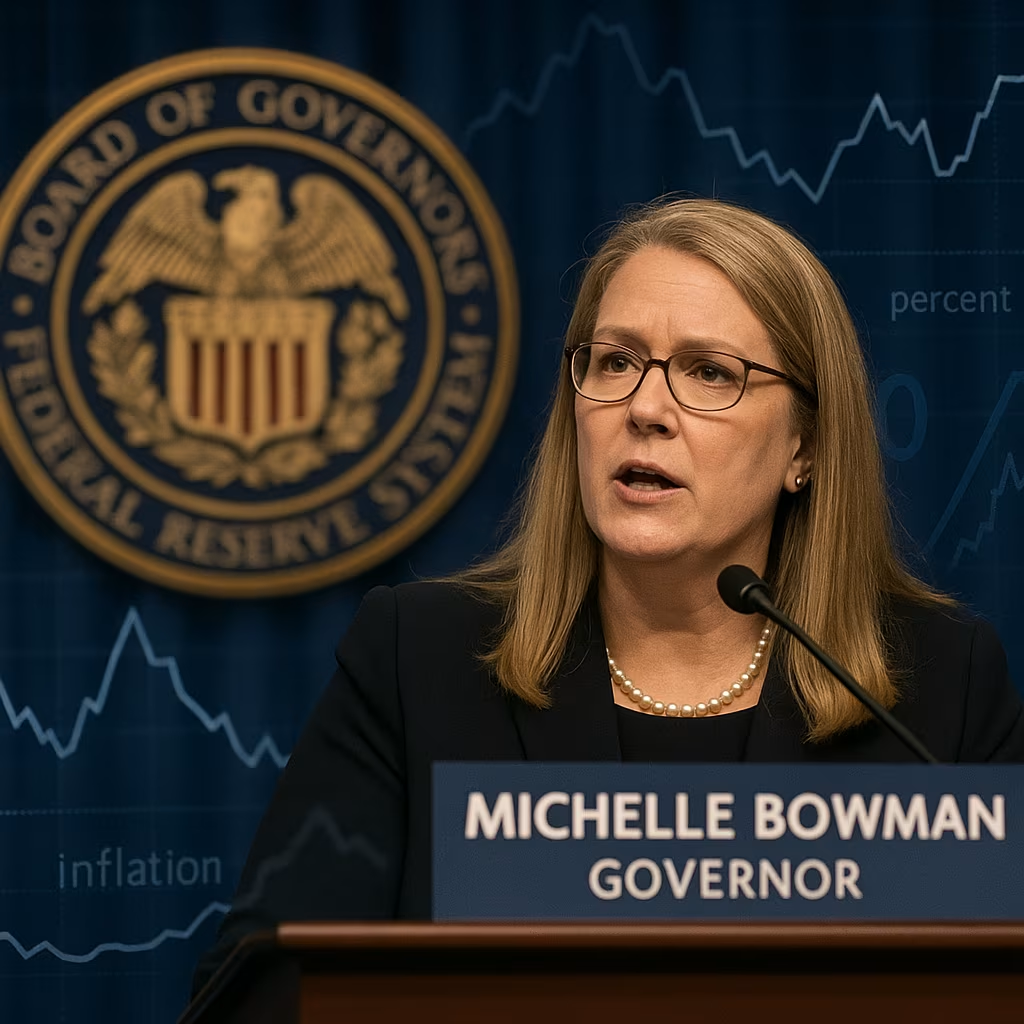

Federal Reserve Governor Michelle Bowman has indicated that she supports implementing three interest-rate cuts before the end of the year, citing progress in reducing inflation and a slowing U.S. economy. Her remarks mark a shift in tone from her traditionally hawkish stance, signaling that policymakers may be preparing for a gradual pivot toward more accommodative monetary policy.

A Shift in Policy Tone

Bowman, long considered one of the more conservative voices on the Federal Open Market Committee (FOMC), has previously stressed the need for caution in easing policy too quickly. However, in her latest comments, she acknowledged that the Fed’s efforts to curb inflation have yielded significant results, creating room for measured rate reductions.

“Inflation has moved closer to our 2% target, and economic growth has moderated in a way that suggests policy can be eased somewhat without jeopardizing our progress,” Bowman said during a speech at a banking conference.

Her support for three cuts aligns with a growing contingent of Fed officials who believe that maintaining the current high-rate environment for too long could risk a sharper slowdown in growth and hiring.

Current Economic Landscape

The U.S. economy has cooled from the rapid pace of post-pandemic expansion. Key indicators show:

- Inflation – The Consumer Price Index (CPI) has eased from a peak of over 9% in 2022 to around 3%, while the Fed’s preferred measure, the Personal Consumption Expenditures (PCE) price index, has also declined toward the 2% target.

- Labor Market – Job growth remains positive but has slowed, with unemployment edging slightly higher and job openings declining from historic highs.

- Consumer Spending – Retail sales have softened as higher borrowing costs and elevated prices weigh on household budgets.

- Business Investment – Companies are showing greater caution in capital spending due to economic uncertainty and tighter credit conditions.

These factors, Bowman suggested, support a gradual easing path to avoid over-tightening and harming the labor market.

Why Three Cuts?

Bowman’s proposed pace of three cuts reflects a middle-ground approach between aggressive easing and a more prolonged holding pattern. The logic is to begin normalizing policy while maintaining flexibility to respond to changing conditions.

- Risk Management – Cutting too quickly could reignite inflation, while waiting too long could trigger unnecessary economic weakness.

- Gradual Adjustment – A steady pace of cuts would allow markets and households to adjust without causing volatility in financial conditions.

- Data Dependence – Each cut would be contingent on continued improvement in inflation data and stability in the labor market.

Market Reaction

Financial markets responded positively to Bowman’s remarks, with U.S. Treasury yields declining slightly and equity indexes gaining ground. Investors interpreted her comments as confirmation that the Fed is leaning toward easing, potentially starting as early as the summer.

Futures markets now price in a higher probability of three quarter-point cuts by year-end, consistent with Bowman’s view.

Not Without Risks

While Bowman’s comments suggest a clear policy direction, she also highlighted risks that could alter the Fed’s plans:

- Persistent Inflation – If inflationary pressures reemerge, the Fed may have to slow or halt cuts.

- Global Shocks – Geopolitical tensions, energy price spikes, or financial instability abroad could complicate the economic outlook.

- Housing Market Effects – Lower rates could boost housing demand, potentially driving prices higher again and affecting affordability.

Bowman stressed that flexibility remains key, and that the Fed will not commit to a fixed path regardless of economic developments.

Broader Policy Debate

Her remarks come amid an evolving debate within the FOMC. Some members advocate for fewer cuts, preferring to keep rates elevated longer to ensure inflation is fully contained. Others see the risk of holding rates too high for too long, especially with the economy already slowing.

Bowman’s shift toward supporting multiple cuts could help build consensus for a gradual easing cycle, bridging the gap between the Fed’s hawks and doves.

Global Context

The Fed’s potential shift comes as other major central banks are also moving toward easing. The European Central Bank (ECB) and Bank of England are considering rate cuts later this year, while some emerging market central banks have already begun reducing rates.

This global trend could help the Fed cut without putting excessive downward pressure on the U.S. dollar or triggering destabilizing capital flows.

Michelle Bowman’s endorsement of three interest-rate cuts in 2025 signals a notable shift in the Federal Reserve’s outlook, reflecting confidence that inflation is under control and that economic conditions warrant a modest policy easing.

While the exact timing will depend on incoming data, Bowman’s stance adds weight to expectations that the Fed will pivot toward a more accommodative stance in the months ahead. For markets, businesses, and households, this could mean lower borrowing costs and a more supportive economic environment — provided inflation remains in check.