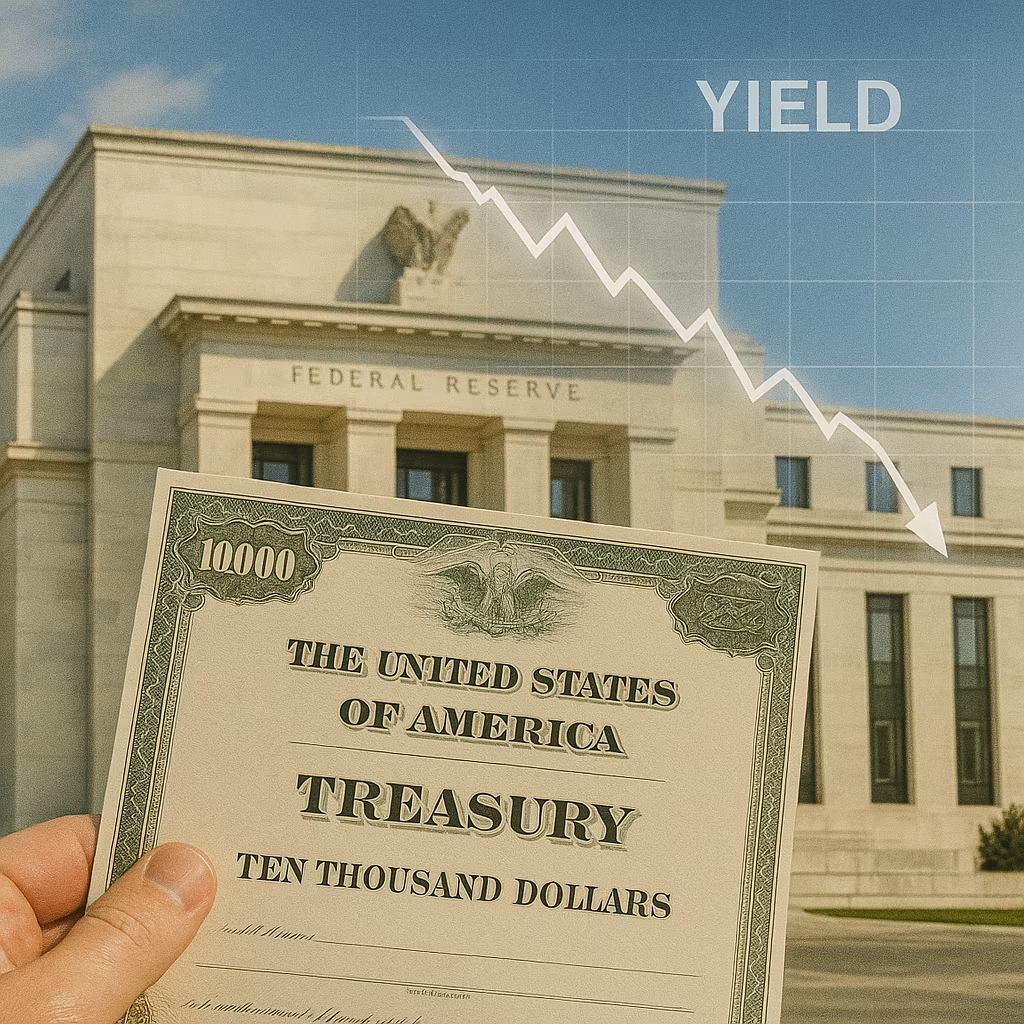

U.S. Treasury yields moved lower this week as bond traders increasingly bet that the Federal Reserve could shift toward a more accommodative monetary policy in the coming months. The move reflects growing market confidence that interest rate cuts may be on the horizon as inflation eases and economic growth shows signs of cooling.

The decline in yields, which move inversely to bond prices, comes amid a broader rally in the bond market, with investors repositioning portfolios ahead of key economic data releases and upcoming Fed policy meetings.

Market Signals Point to Potential Fed Pivot

The yield on the benchmark 10-year Treasury note fell to its lowest level in several weeks, while the 2-year yield — often seen as a proxy for Fed rate expectations — also declined sharply. Market participants are interpreting the drop in short-term yields as a sign that traders believe the Fed’s rate-hiking cycle is nearing its end.

This shift in sentiment follows recent inflation reports showing that price growth continues to moderate toward the Fed’s 2% target, as well as economic indicators pointing to a gradual slowdown in hiring and consumer spending.

Economic Data Driving the Bond Rally

Several factors have combined to fuel demand for Treasurys:

- Cooling Inflation Data – Both the Consumer Price Index (CPI) and the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, have shown steady declines from their 2022 peaks.

- Slowing Labor Market – Job growth remains positive but is decelerating, reducing the risk of wage-driven inflation.

- Weaker Economic Indicators – Softness in manufacturing output, retail sales, and housing market activity suggests the economy may be entering a slower growth phase.

These trends have led traders to speculate that the Fed will soon prioritize supporting economic growth over fighting inflation, potentially cutting rates in the next policy cycle.

Investor Positioning and Demand for Safe Havens

In addition to shifting Fed expectations, global investors have sought the safety of U.S. government debt amid persistent geopolitical uncertainty and market volatility. Treasurys remain one of the most trusted safe-haven assets, attracting inflows when risk sentiment declines.

Institutional investors, including pension funds and insurance companies, have also increased Treasury purchases to lock in higher yields before potential rate cuts reduce returns on newly issued bonds.

Yield Curve Implications

The Treasury yield curve — the difference between short-term and long-term yields — remains inverted, with shorter maturities offering higher yields than longer ones. Yield curve inversions have historically been seen as recession indicators, though many economists caution that the relationship may be less reliable in the post-pandemic environment.

Still, the narrowing gap between 2-year and 10-year yields could suggest that the market is preparing for a policy shift that will eventually steepen the curve as short-term yields fall.

Fed Officials Maintain a Cautious Tone

Despite market optimism, Federal Reserve officials have been careful to avoid signaling an imminent rate cut. In recent remarks, policymakers have emphasized the importance of ensuring that inflation is firmly on track to return to target before adjusting policy.

However, they have also acknowledged that rates are currently at restrictive levels and that maintaining them for too long could risk slowing the economy more than necessary. This nuanced messaging has kept traders on alert for any signs of a pivot.

Potential Risks to the Bond Market Rally

While falling yields reflect market optimism about a Fed shift, several risks could reverse the trend:

- Stronger-than-expected inflation data could push expectations for rate cuts further into the future.

- Resilient consumer spending or job growth could give the Fed more reason to keep rates higher for longer.

- Global market shocks — such as energy price spikes or geopolitical escalations — could complicate the Fed’s policy path and create volatility in bond markets.

The Global Context

U.S. Treasury yields are also being influenced by developments abroad. Central banks in Europe, the U.K., and parts of Asia are weighing similar policy shifts as inflation cools and growth slows. In some cases, foreign investors are finding U.S. Treasurys more attractive than domestic bonds, which further supports demand and keeps yields in check.

The global bond market’s interconnectedness means that a policy pivot by one major central bank can have ripple effects across borders.

Long-Term Outlook

If the Fed begins cutting rates in the coming months, yields could fall further, particularly on the short end of the curve. However, much will depend on the trajectory of inflation, labor market strength, and overall economic growth.

For now, traders are positioning for a softer Fed stance, with the expectation that monetary easing could support both bond and equity markets in the latter part of the year.

The drop in Treasury yields underscores a growing belief among bond traders that the Federal Reserve is nearing a turning point in its policy cycle. While the timing and scale of any rate cuts remain uncertain, moderating inflation and signs of slower economic growth have shifted market expectations toward a more accommodative stance.

As always, incoming data will be critical in shaping both Fed decisions and bond market trends. Until then, investors are likely to keep a close eye on every inflation print, jobs report, and policy statement for clues about the central bank’s next move.